How to Choose the Right Taxation Service for Your Business Needs

Navigating the complexities of business taxation can be challenging, especially for small and medium-sized enterprises trying to stay compliant while focusing on growth. Whether you’re launching a startup or managing an established business, having the right financial support is essential and that starts with choosing the right taxation services in UK.

A professional taxation service not only helps with accurate filings and deadline management but also ensures that your business takes full advantage of all available reliefs and allowances. Especially when dealing with regulations like VAT in UK, which can vary based on thresholds and industry type, expert guidance is key to staying compliant and avoiding costly penalties.

1. Know What You Need

Start by assessing your business’s specific requirements. Do you need help with annual tax filing, VAT returns, payroll taxes, or full-scale financial planning? Are you looking for support during tax season only, or do you want a year-round partner to guide your business through changing tax laws?

Clearly identifying your needs helps you find a taxation service that specializes in your sector, understands the size and structure of your business, and offers tailored advice instead of a one-size-fits-all solution.

2. Verify Qualifications and Industry Expertise

Always ensure the provider is qualified and experienced. Look for chartered accountants (CAs), tax advisors, or licensed professionals who understand the UK tax system thoroughly. They should be familiar with specific rules that apply to your sector, whether it’s hospitality, e-commerce, construction, or consulting.

Good tax preparation services will also be able to handle VAT in UK filings confidently, ensuring that you register at the right time, reclaim input tax properly, and submit accurate VAT returns every quarter or as required.

3. Check Their Use of Technology

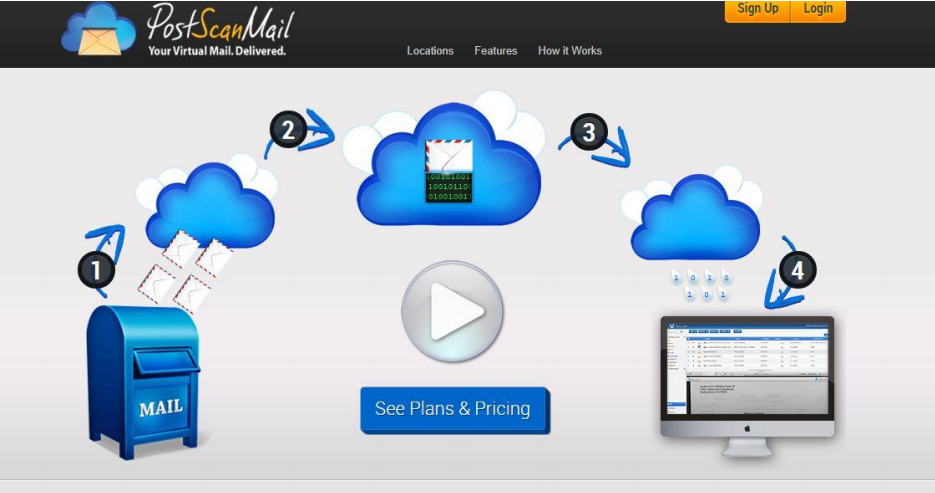

Modern tax services should offer digital tools that make compliance faster and easier. This includes cloud-based accounting software, digital document management, e-signature capabilities, and automated alerts for important dates. If your service provider is still relying on outdated systems, it may lead to inefficiencies and errors.

Ensure the provider can work seamlessly with platforms like QuickBooks, Xero, Sage, or whichever system you use or guide you in choosing the right one.

4. Evaluate Communication and Accessibility

A reliable taxation partner should be responsive and available when you need them. Pay attention to how quickly they respond to your queries during the initial consultation. Do they offer regular updates? Can they explain complex tax terms in a way you understand?

Choose a firm or individual who treats your business seriously and is proactive in offering solutions, not just reactive during tax season.

5. Understand Pricing and Transparency

Pricing structures can vary widely. Some services charge a fixed monthly fee, while others may bill hourly or per filing. Ask for a detailed breakdown of costs and confirm what’s included VAT returns, payroll, annual reports, self-assessments, or consultation.

Transparent pricing helps avoid surprises and ensures you get value for the services offered. Don’t automatically go with the cheapest option; the quality of support and advice matters far more in the long run.

6. Look for Year-Round Support and Advisory

Many businesses make the mistake of contacting a tax advisor only when the deadline looms. But a great taxation service offers more than just filing they provide insights that help your business grow. Look for someone who can advise you on tax planning, managing expenses, improving cash flow, and adjusting to new regulations.

Especially when dealing with taxation services in the UK, a year-round advisor ensures you stay ahead of changes from HMRC, manage VAT obligations efficiently, and take advantage of government incentives or deductions.

7. Assess Credibility and Client Experience

Before making a final decision, take a moment to review the provider’s overall reputation. Check for genuine client feedback, past results, and how long they’ve been in the industry. A reliable taxation service should be open about their experience, share examples of their work, and have a strong record of client satisfaction. Consistent, positive feedback is often a good indicator of trustworthy and professional service.

Conclusion

Choosing the right taxation service is an investment in your business’s stability and long-term success. With the right provider by your side, you’ll have more than just peace of mind you’ll have a proactive partner who understands your business, ensures compliance with rules like VAT in UK, and helps you grow strategically.

Take your time to research, ask the right questions, and find a partner who aligns with your goals. The right taxation service can make all the difference.

How Your Business Can Benefit From Protective Screens

What Are The Main Advantages Of Using A Marketing Agency?

7 Benefits Of Using Internet Marketing For Your Business

A Guide To Advertising A Brand New Business